The fear of the government of Abdel Fattah al-Sisi about the consequences of the continuation of conflicts in the Red Sea for Egypt

| Some international trade analysts believe that with the continuation of the shipping crisis in the Red Sea, Egypt will be one of the biggest "losers" of the Palestinian conflict. The published statistics also confirm that the traffic of commercial ships through the Suez Canal has decreased by 36%. |

According to the international group Tasnim News Agency, one of the consequences of the erosion of the Zionist regime’s attacks on Gaza , the insecurity of the Red Sea for ships connected to the ports of the Zionist regime and the governments that support Tel Aviv.

With the beginning of the series of ground-air attacks of the Zionist regime against the Gaza strip, the axis of resistance based on the strategy of “unity of the fields” decided to According to the capabilities, geopolitical position and local conditions of each member of the resistance network, the interests related to the Zionist regime and its allies (CENTCOM) in the West Asia region should be targeted in a “limited” manner, in order to establish the ground for a lasting ceasefire. , lifting the blockade and exchange of prisoners.

In this campaign, the Yemeni National Army is in a special position to target the south of Palestine due to its location in the northern Indian Ocean and the complete control over the Suez-Bab Al-Mandab trade line. occupation and the insecurity of the maritime trade route. Uploaded/Image/1402/11/24/14021124093625274293853210.jpg”/>

The Red Sea crisis and the decrease in the passage of commercial ships through the Suez Canal

The series of actions of the Yemeni government in the Red Sea led to First, Washington should talk about the formation of a coalition known as “Guardians of Welfare” to create a safe passage for commercial ships, and then, by forming a military coalition with Britain, put air strikes on strategic targets in Yemen on the agenda.

Recently, the European Union announced by approving a plan that it is pursuing planned military operations for what is called “securing the passage of commercial ships in the Red Sea”. Is. The increase in tensions in the geostrategic range of the Indo-Pacific has caused the interests of many important regional and international actors to be jeopardized. Meanwhile, Egypt’s ownership of the Suez Canal has made Cairo one of the main parties involved in the Red Sea crisis. In the continuation of this note, we will try to have a look at the opportunities and challenges of this maritime crisis for the government of Abdel Fattah al-Sisi.

Try to end the war

Egypt to The reason for having a common border with the Gaza strip and occupied Palestine is more than other regional actors involved in the effects of the Gaza war. During the last four months, Cairo has always tried to help in the capacity of “mediator” and “facilitator” in the process of transferring humanitarian aid to prevent the export of crisis and the formation of the future government of Gaza.

The presentation of Egypt’s three-stage plan for the end of the war, the exchange of prisoners and the return of unified Palestinian sovereignty can be evaluated as an attempt to manage the crisis in the eastern borders of Egypt. The Egyptian authorities are perhaps more concerned about the financial losses caused by the crisis in the Red Sea, the arrival of refugees from the Rafah crossing towards the Sinai desert, the continuation of the humanitarian aid delivery line, and Israel’s re-control of the Philadelphia axis in the south of Gaza.

The impact of the Red Sea crisis on the reduction of Egypt’s revenues

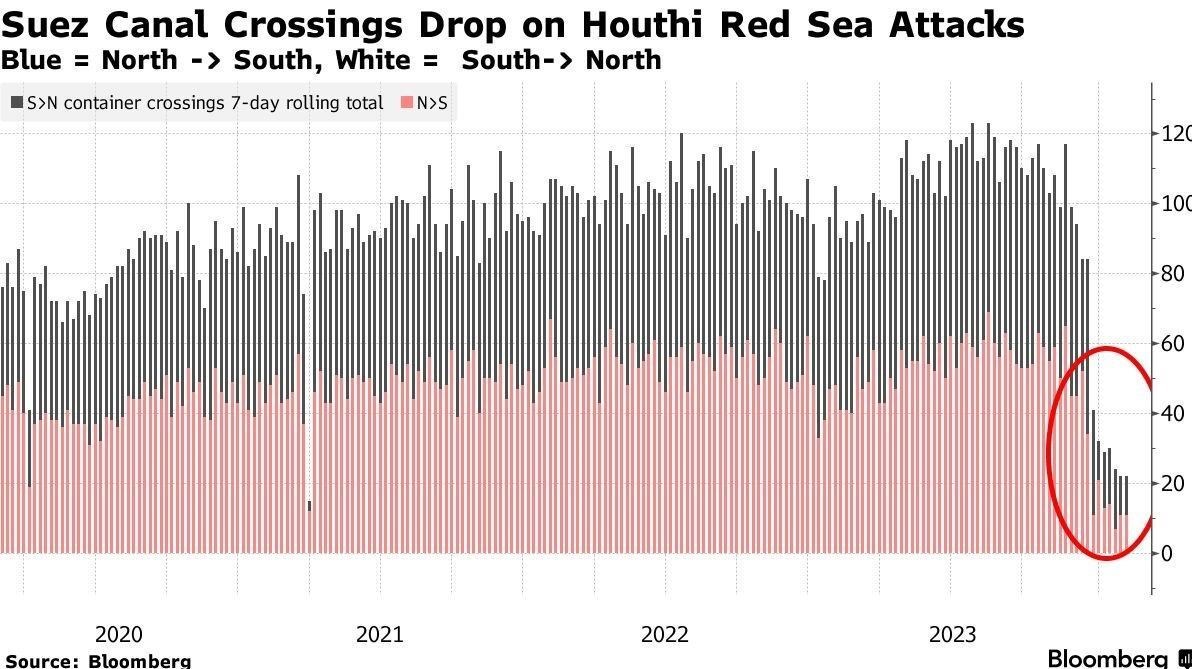

Some international business analysts believe that with the continuation of the shipping crisis in the Red Sea, Egypt will be one of the biggest “losers” of the Palestinian conflict. In the first month of this year, Egypt’s income from the Suez Canal has been reduced by half. The amount of income from this international waterway in January 2024 was only 428 million dollars. This is despite the fact that last year due to the lack of security crisis in the region, this figure had reached 804 million dollars. In addition, in January 2024, the number of ships passing through this canal has been announced as 1362, which has registered a 36% decrease (2155) compared to last year.

Egypt’s dramatic decrease in income From Suez Canal – Bloomberg

Osameh Rabiei, the head of the Suez Canal Authority, announced in a TV interview with “ON TV” that the Egyptian government will take about 2.2 percent of It derives its GDP from annual balance of payments revenues and 1.2% of its GDP from fiscal revenue from Suez Canal tolls. This issue has caused the authorities of Cairo to speed up the financial negotiations with the International Monetary Fund in order to compensate for possible damages, so that they can increase the loan amount of 3 billion dollars from this international institution to escape the economic crisis.

Emergence of new routes

In the classical history of international relations, one of the main reasons has been the discovery of “new ways” of competition and conflict between the interests of great powers in different fields. The (temporary) insecurity of the commercial shipping route in the Red Sea has disrupted 20% of world trade. Following the actions of the Yemeni resistance against the interests of the Zionist regime in the region, the amount of insurance and fuel for ships has increased significantly due to the increased risk of navigation in the northern Indian Ocean. In such a situation, major shipping companies such as “Maersk”, “Mediterranean” and “Hapag-Lloyd” announced that instead of crossing the traditional Suez-Mediterranean route (25 days), they prefer to go from the south of the African continent, i.e. Cape Omidnik (34 days). Move to destination markets. Such a development has caused the route of many commercial ships to be changed in a short period of time and a significant delay in the process of sending all kinds of goods, grains, fuel, etc. to the destination ports.

Changing the route of commercial ships from the Suez Canal to the Cape of Good Hope

Another important route that is the result of the current crisis in the Red Sea can be called the “Persian Gulf-Mediterranean” land corridor. Previously, the “Dubai-Haifa” land line was supposed to be launched, but Yemen’s resistance actions in the northern Indian Ocean caused a new route to be formed with the participation of some member countries of the Persian Gulf Cooperation Council.

In this new route, the ships dock in the UAE or Bahrain ports and then go to occupied Palestine and Egypt via the land route of Saudi Arabia and Jordan. According to the information published by Hebrew sources, in this new route, almost 80% of the transportation time has been saved, and at the same time, it is no longer necessary for Tel Aviv to pay the high cost of insurance or fuel for ships. The companies “DP World”, “Askandria”, “Traknet” and “Pure Trans” are among the main operators of this new land route.

After the Suez Canal War in 1956, the Suez-Bab Al-Mandab region has not been affected by geopolitical conflicts in the Eastern Mediterranean at any time like today. According to Reuters, nearly 60 percent of Egyptians are close to or below the poverty line. Growing economic problems such as unbridled inflation, devaluation of the national currency, pressures caused by foreign immigrants, increasing unemployment, etc. have caused the economic burden of the Red Sea crisis to be felt more and more in the Egyptian economy. Although the actions of the Yemeni resistance strengthen the possibility of a ceasefire in Gaza; But the continuation of this process can cause serious damage to Egypt’s economy.

end of message/

| Publisher | Tasnim News |