What are the economic challenges in trade relations between Iran and Armenia?

Mehr News, International Group: Armenian authorities For years, Iran and Iran have targeted the trade volume of one billion dollars as a favorable indicator for trade between the two countries, and they have recently discussed the three billion dollar index. As we consider the dynamics of Armenian-Iranian trade, it becomes more and more obvious that the ceiling of three billion dollars will probably be broken in the near future. Moreover, while we are gradually approaching our $1 billion goal, we have yet to reach this threshold. However, we are close to this goal.

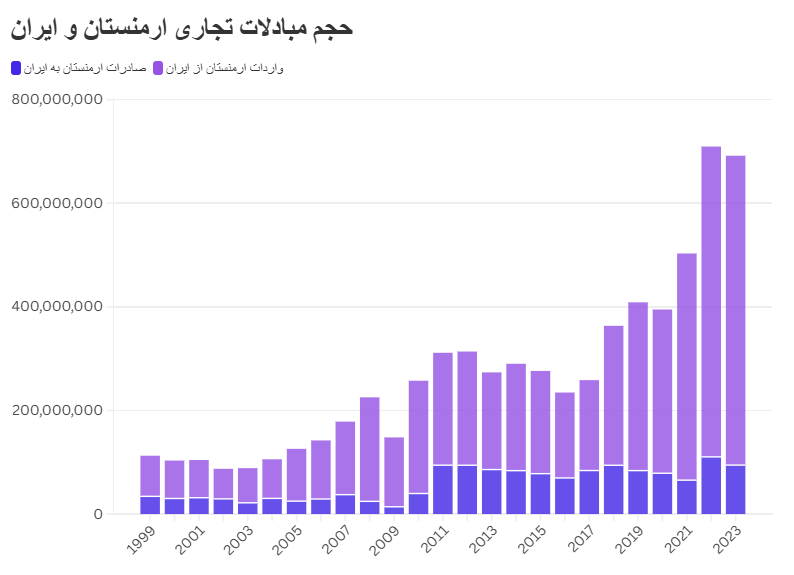

The volume of trade between Armenia and Iran in 2021 will exceed half a billion dollars for the first time, and in 2022, this figure will exceed 700 million dollars. According to available data, bilateral trade in 2023 was equal to 690 million dollars, which shows a slight decrease compared to the previous year. In general, the trade volume of Iran and Armenia has had a positive trend in recent years.

Although this is a commendable achievement, a closer look at the nature of Armenian-Iranian trade reveals some important trends. Specifically, the trade balance has been severely distorted. Imports from Iran have been far more than exports. According to the data of 2023, almost 84% of Armenian-Iranian trade is made up of imports from Iran.

If we look at the data of the last 10 years, specifically between 2013 and 2023, we can see that although both imports from Iran and exports to Iran have It has been fluctuating, sometimes increasing and sometimes decreasing, but exports from Iran to Armenia have been increasing. On the other hand, Armenia’s exports to Iran have been relatively uniform during this period.

I believe that if the trade imbalance is managed to some extent, the trade circulation will experience more stable and faster growth. Resolving this conflict will also contribute to more stable and long-term economic cooperation. Although this disharmony is a natural product of the economic structure of both Armenia and Iran, accepting this issue in Iran is encouraging. Therefore, both countries should make more efforts to resolve this issue.

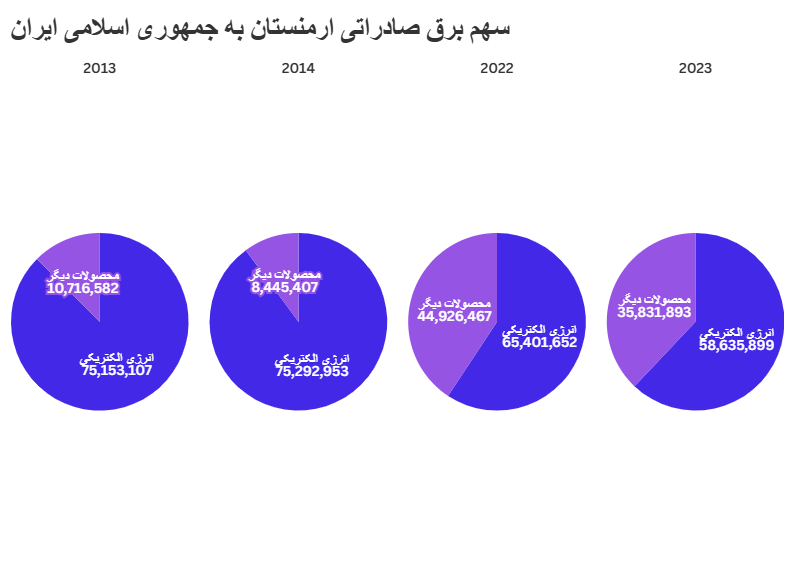

Another issue that affects our business is the content of Armenia’s exports to Iran. More than 50% of this export is electricity sector. In some years, for example in 2013 and 2014, the share of electricity in total exports was 90%. Recently, of course, this process has somehow improved; In 2023, the share of electricity was 62%. In addition, the range and variety of exported products to Iran has also expanded.

Despite this positive change, electricity still constitutes the majority of Armenia’s exports to Iran. This issue shows that although exports are increasing, diversifying export goods is still considered an urgent need.

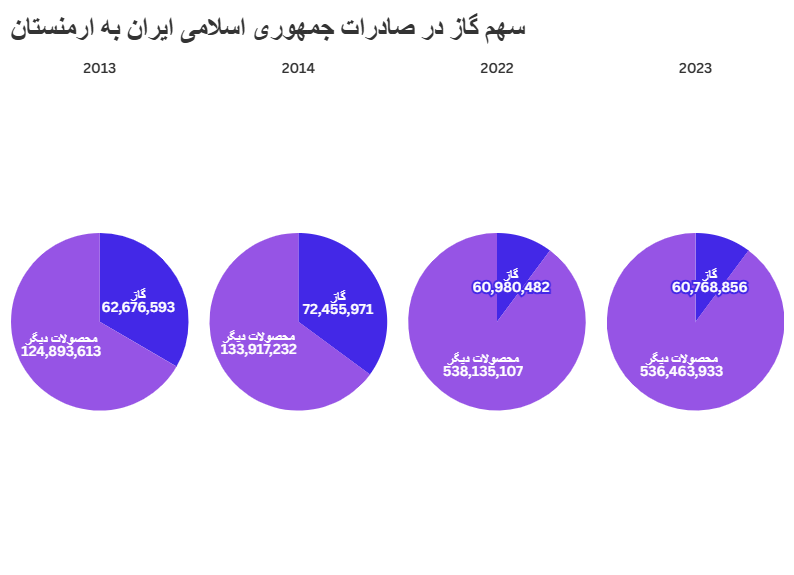

For a comparison, it is interesting to know that although gas is the main export from Iran, the goods imported from this country are much more diverse, and gas is imported as electricity. Armenia’s export to Iran is not significant. Significant changes have been made in this regard. In 2023, the total share of exports from Iran to Armenia will be only 10%, while this figure was 33% in 2013. The reason for this decrease was to a large extent the growth of exports of other goods. In addition, in 2023, the main export from Iran to Armenia was iron and non-alloy steel. Among other important export goods, we can mention petroleum products, construction materials, fruits and vegetables, metals and detergents.

When we look at the leading export goods from Armenia to Iran, we see their diversity and change over the years, but the main categories are as follows:

Cos

cigarettes

Sheep and mutton

Chocolate

Iron and steel

tool drive engine

Motorcycle

In 2020, due to the epidemic of Covid-19, ethanol (non-edible) was also among the leading export products.

Another important component that I want to mention is the impact of the temporary free trade agreement signed between the Eurasian Economic Union (EAEU) and Iran in the field of Armenian-Iranian trade. they did Based on this agreement, 360 items were added to the list of preferential and reduced customs tariffs for exports from the Eurasian Union to Iran, as well as 502 items for imports from Iran to Eurasia.

In order to clarify this issue, three years before this agreement, in 2016, the bilateral trade between Armenia and Iran was equal to about 230 million dollars, so that almost 70% of it was imported from Iran to Armenia. Of this import volume, only 12.3% was from the categories that were later added to the list of goods with preferential tariff.

Trade between the two countries will increase to about 710 million dollars in 2022, of which 84% will be imports to Armenia. However, the share of premium goods doubled and reached 25.3%. This shows that the goods subject to preferential tariffs became cheaper for the final consumer in Armenia.

When it comes to exports from Armenia, the situation is different. In 2016 and before the aforementioned agreement, 16% of Armenia’s exports to Iran were supplied from categories that were later included in the preferential tariff list. This share reached only 2.4% by 2022 and mainly included chocolate and other related goods.

In other words, the export of goods subject to preferential tariff decreased significantly and reached a negligible level. This issue shows that Armenian businesses have not been able to take full advantage of the opportunity to export cheaper goods to the big market of Iran due to various reasons. This issue is different from the conditions of other Eurasian Union members such as Russia and Kazakhstan; Countries where more than half of their exports are made up of goods that benefit from preferential tariffs.

Considering all aspects, I believe that such events provide a wonderful platform to highlight the aspects and challenges facing the developments of bilateral relations, including trade and economic relations, and It supports efforts to overcome these obstacles through joint action.