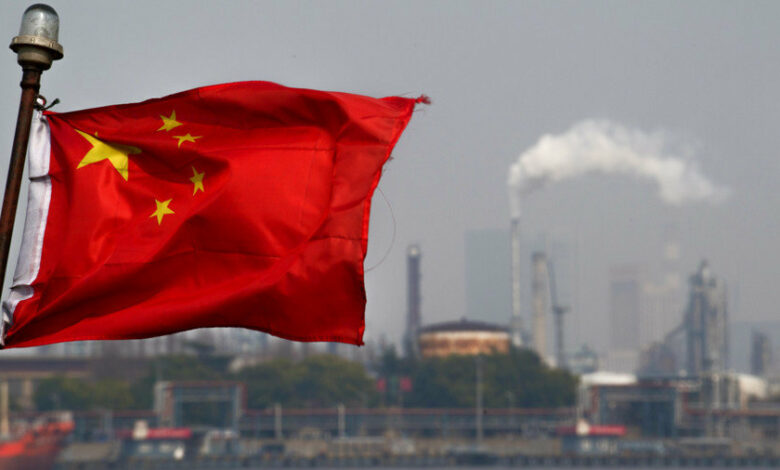

China’s Oil Imports Surge Amid Increased Purchases from Iran

According to the Economic Desk of Webangah News Agency, data indicates that November imports saw a 5.24% increase compared to October. Total oil imports from January to November rose by 3.2% year-over-year, reaching 521.87 million tons, equivalent to 11.45 million barrels per day.

Russian oil shipments decreased by 157,000 barrels per day in November, averaging 1.19 million barrels per day. In contrast, imports from Saudi Arabia increased by 345,000 barrels per day to 1.59 million barrels per day, making Saudi Arabia China’s top oil supplier for November. Iranian oil shipments also increased significantly, rising by 233,000 barrels per day from October to an average of 1.35 million barrels per day.

Emma Li, head of China analysis at Vortexa, told Reuters that domestic demand has faced seasonal declines, but sanctions on Iranian and Russian oil exports have led to significant feedstock price reductions, boosting refining margins. This has incentivized more refineries to apply for import quotas ahead of the first import quota issuance in 2026.

The oil import data follows forecasts suggesting that crude oil demand in the world’s largest importer will likely remain weak until at least mid-next year. Earlier this year, the Economics & Technology Research Institute, a market research unit of state-owned CNPC, stated that while stronger-than-expected economic growth and increasing demand for petrochemicals will increase China’s oil demand by 1.1% this year, transportation fuel consumption has peaked.

According to OilPrice, independent refineries in Shandong are increasing oil purchases and refining following Beijing’s issuance of new crude oil import quotas. This buying reduces oil stocks in storage, and analysts believe it could diminish the anticipated oversupply by year’s end.