Crude oil and natural gas price growth amid political developments and seasonal demand

reported by %20%0A

Global energy markets witnessed significant fluctuations during the last week. Crude oil and natural gas futures rose as concerns grew about the impact of sanctions on Russian energy, dwindling oil inventories and winter fuel demand. Meanwhile, speculation about possible changes in US energy policies under the Trump presidency and reports of a ceasefire in the Middle East fueled price reversals. With entering the winter season and possible changes in international policies, the energy market is shaping a new perspective.

WTI and Brent oil growth

WTI crude oil futures rose above $79 a barrel on Friday, paring some of the previous session’s losses. At the same time, this oil is moving towards the fourth consecutive weekly growth. The overnight drop came amid speculation that US President-elect Donald Trump might ease Russian energy sanctions as part of diplomatic efforts to resolve tensions between Russia and Ukraine. Also, reports of a ceasefire in the Middle East helped reduce geopolitical risk.

Crude oil Brent experienced a similar trend by reaching $81.6 per barrel. However, the oil market remains weighed down by concerns about the impact of US sanctions on Russian energy flows, declining US oil reserves and winter fuel demand. The expectation of a further reduction in interest rates by the Federal Reserve can also stimulate economic activities and lead to an increase in energy demand.

US natural gas market

US natural gas futures rose 5% to $4.3/MMBtu on Thursday, the highest level in two years. The increase was due to the forecast of extreme cold weather and the EIA report of a significant decrease in gas reserves. Federal data showed that 258 billion cubic feet of gas was withdrawn from reserves in the week ending Jan. 10, well above last year and the five-year average. Forecasts show that more reductions will be reported in the coming weeks, beyond 200 billion cubic feet.

Falling gasoline futures

U.S. gasoline futures fell to $2.11 per gallon. The drop came after the EIA reported a 5.852 million barrel increase in gasoline inventories, which exceeded forecasts. In contrast, crude oil inventories fell for the eighth consecutive week and reached their lowest level since April 2022.

Newcastle Coal View

Newcastle coal futures remained near $115 a tonne, near four-year lows. The increase in China’s production and high coal inventory, along with the growth of hydroelectric energy consumption, have put pressure on coal demand.

Generally As Trump’s presidency approaches, the possibility of policy changes such as tariffs on Canadian oil and increasing domestic production America has caused changes in the energy market. At the same time, the forecast of economic growth and seasonal demand are among the key factors supporting the energy market in the coming months.

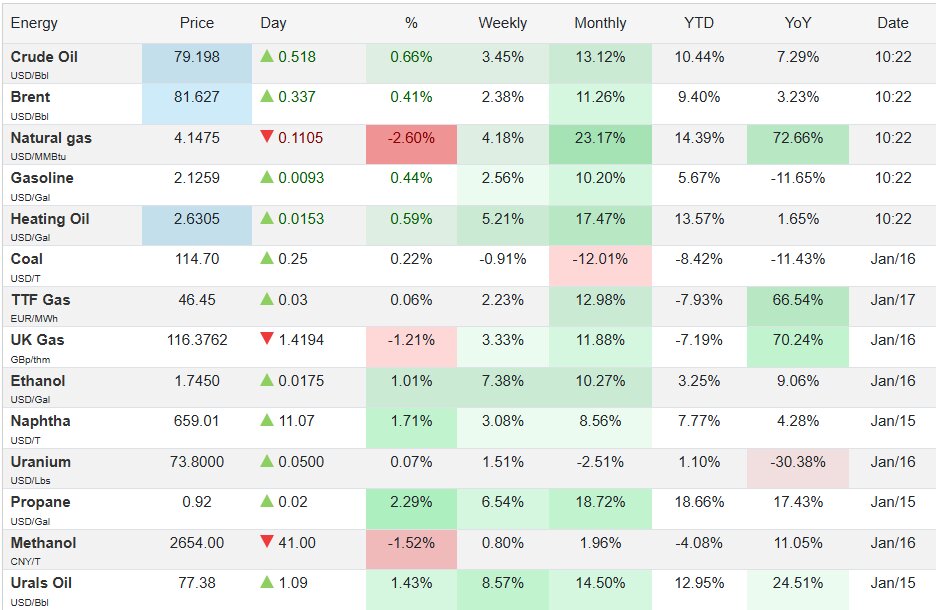

The last global price of oil and energy today, Friday, January 28, 1403

The table below shows the latest global price of oil and other forms of energy in one frame.